05. Performance in the Year GRI 103-2, 103-3 | 203, 203-1, 203-2

In this chapter we present a summary of how our year was. The main initiatives and projects developed throughout 2021 are reported below. Some of them are part of the Action Plan, which guides ANBIMA’s activities each year.

We also present the work developed for our in-house team, with a focus on people, management, and sustainability. Lastly, the financial report consolidates the financial statements for the fiscal year.

Initiatives and projects

In the second half of each year, we prepare the action plan that guides our work in the following year. It is compiled based on several rounds of conversations with ANBIMA members, who bring us their market perceptions and demands that can be included on the Association’s agenda. Parallel to this, the major trends in the Brazilian and international markets are identified.

Throughout the process, institutions that do not occupy seats in the Association’s forums, committees or other groups are heard as well, in addition to all the leaders of these same bodies that comprise our governance. Thus, we ensure the representation of the various market segments and institutions of different sizes and operating profiles.

The result is a set of initiatives that reflect what the market wants as a focal point for ANBIMA in that year. This work is ultimately validated by the Executive Board. Since the market is dynamic, initiatives are reassessed on an ongoing basis, and new actions may also be included in the plan.

The result is a set of initiatives that reflect what the market wants as a focal point for ANBIMA in that year. This work is ultimately validated by the Executive Board. Since the market is dynamic, initiatives are reassessed on an ongoing basis, and new actions may also be included in the plan.

The Positive Agenda sought to meet demands related to investors, the capital market, the secondary market, and asset management. The Transversal Agenda included initiatives related to sustainability, innovation, diversity, and taxes.

Below is a summary of what has been done for each of them, plus other relevant initiatives that were not part of the action plan.

In addition to the initiatives that are part of the Action Plan, other projects focused our attention in 2021:

ANBIMA Summit 2021

With the credibility of 20 years of our Investment Funds Congress, the ANBIMA Summit debuted in 2021 by expanding horizons: the event featured more than 30 hours of discussions on investment management, advisory and recommendation activities, and was attended by market references and experts.

Held from October 25th to 29th, the free event provided participants with an opportunity to network and expand their knowledge, with new connections and innovative experiences.

The 2021 ANBIMA Summit was attended via different online platforms. The future of asset management, practices of sustainability, implementation of open banking, the role of investment influencers in the market, innovation, and macroeconomic challenges are among the topics addressed at the congress, which are still available on the ANBIMA Summit channel on YouTube.

+ 118,000

views on social media

80 speakers

remote and in-person across the five-day event

5,000 participants

registered in an exclusive platform for online networking

9,6

was the average market satisfaction score

Panels in interactive

and innovative formats: interviews, debates, TEDs, video reports

40,000 simultaneous views

in webcasts on LinkedIn, Twitter, Facebook, YouTube, and on the event’s website

Accessible content

audio description, Brazilian sign language, closed-captioning/subtitles. Simultaneous translations in English and Portuguese

14

sponsors

Investor Education and Certifications

In addition to certifying market professionals, we offer continuous improvement through our education platform, which concentrates on all of the courses offered by the Association. Since 2020, all course content is offered free of charge, and last year we reformulated the tool. The changes were released to the public in early 2022: the platform follows the learning management system (LMS) model, a format that allows for the subjects to the created, managed and organized by learning trails. On these trails, users can consume the material by knowledge level, and even by specific skills or themes.

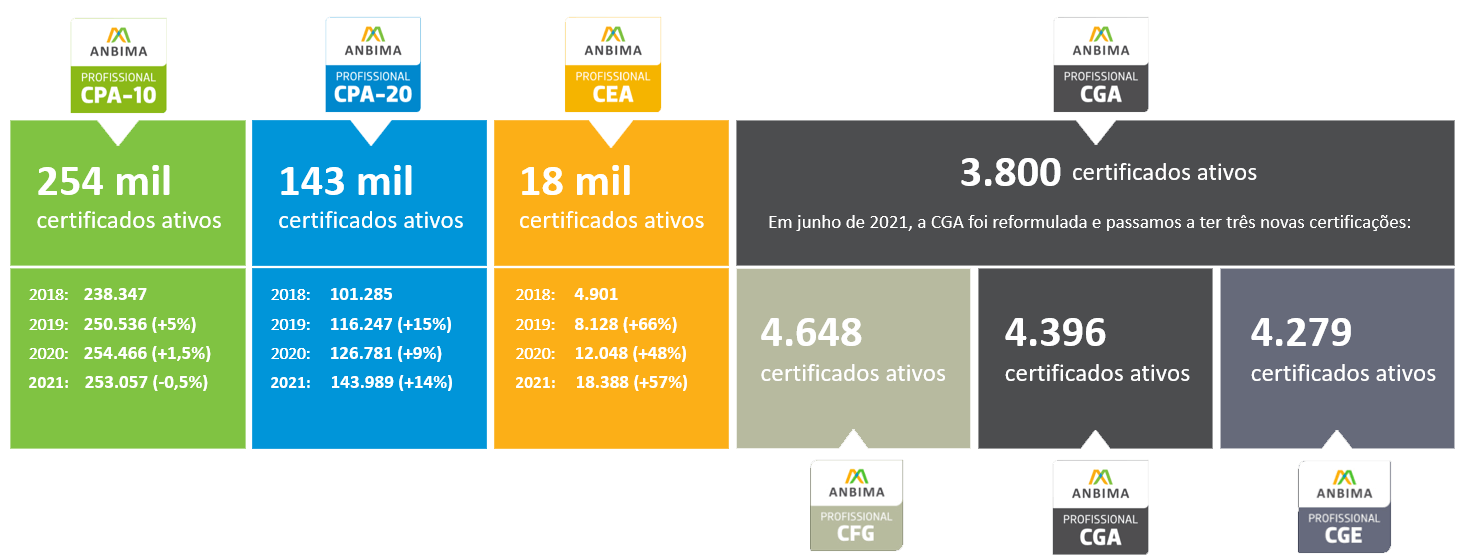

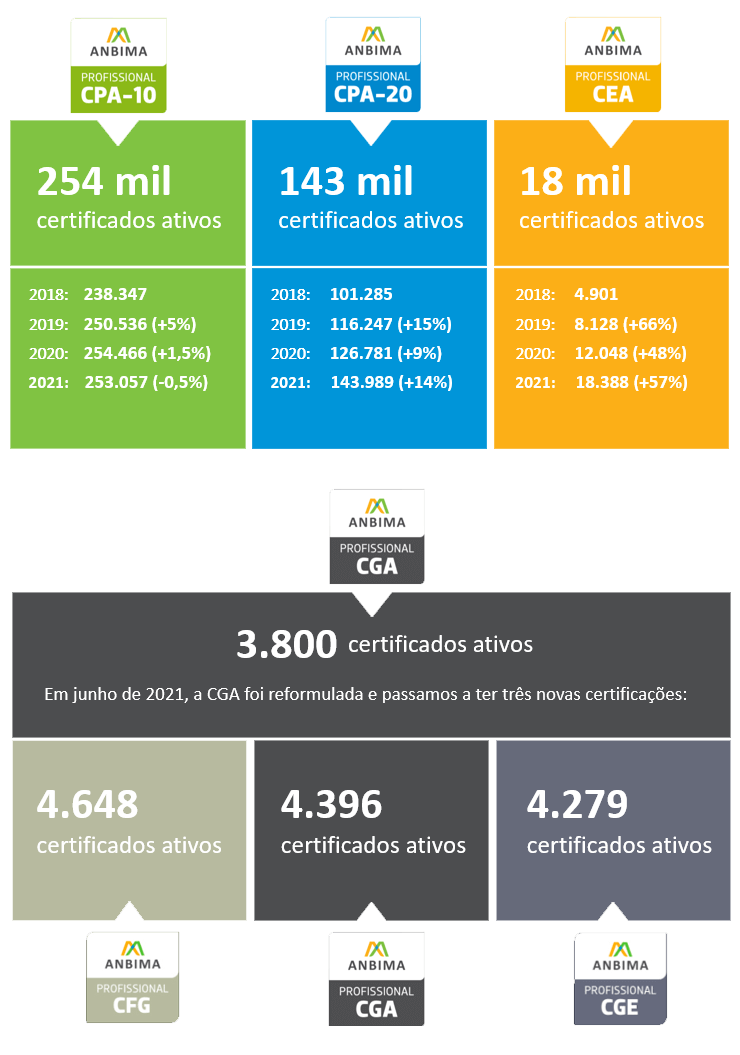

Our certifications for market professionals – CPA-10, CPA-20, CEA e CGA – record continuous growth, both in the number of registrations and in the number of active certificates. In 2021, there were record numbers, which reflects the greater interest in these titles by people and institutions, a clear indicator of improvement in market professionals’ qualification levels.

Below we show the evolution of the numbers of our certifications:

A milestone in 2021 was the entry into force of the new CGA (ANBIMA Management Certification), which we reformulated to adapt to the reality of the market. There are now three certifications which complement one another: the CGE, for professionals who manage structured funds; the CGA (ANBIMA Manager Certification), for managers of fixed-income, equity, foreign exchange and multimarket funds and managed portfolios; and the CFG (ANBIMA Management Fundamentals Certification), entry-level certification for those who wish to work in the asset management market; it is not mandatory for any specific job duty, nor does it qualify the professional to be a manager, but it is pre-requisite for the others, serving as an introductory certification.

The change follows market trends for a better definition of responsibilities for area professionals. Moreover, it is fully aligned with our purpose of promoting continuing education.

The first exams in the new format began in June. With the entry into force of the new certifications, all professionals who were already certified in the previous model automatically became holders of the three new certifications.

Digital Influencers GRI 102-43

By disclosing more accessible information about investments, the activity of digital influencers contributes toward the financial education of Brazilians – with gains for society as a whole. Therefore in 2020, we started monitoring them on a daily basis – with support from the Brazilian Institute for Research and Data Analysis (IBPAD), in order to understand who these agents are, how they behave, and the level of influence they have on their audiences.

This up-close look contributes to the Association’s strategy in several ways: identifying market trends in real-time, which can provide input to the representative groups; overseeing advertising content about investments; improving our communication, marketing, and financial education agendas; and generating insights for the activities of members.

266 influencers

160,000 posts

74 million

followers

As a result of this monitoring, we released an unprecedented study on this universe, with data collected from September 2020 to February 2021. We identified 266 influencers on Facebook, Instagram, Twitter and YouTube, which jointly account for 160,000 posts. They speak with 74 million followers, a figure that surpasses the reach of the social media accounts of the foremost news outlets in Brazil (69 million followers).

The repercussion of the study was positive amoung Association members and the press, which is why it will be continuously updated – a new edition was launched in early 2022. Other specific clippings were published, and an exclusive weekly report for members began being disseminated. The study is available for download on our website; a video is also available on YouTube.

Additionally, in October we entered into an agreement to share our digital influencer monitoring information with Brazil’s Securities and Exchange Commission (CVM). The partnership allows the regulatory agency to identify any social media personas that go beyond the limit of financial education and encroach into product recommendation – an activity that requires registration with the CVM.

Summing up our oversight activity

Completely adapted to remote work because of the COVID-19 pandemic, our market oversight activity remained in full swing throughout 2021, with advances in the digitization and automation of tasks through robotic process automation (RPA) to collect and analyze data. New digital tools and systems were engaged and deployed to strengthen our operations, mainly for overseeing investment funds, public offerings, and distribution of investment products.

We closed out 2021 with 1,184 institutions following the rules of the ANBIMA self-regulation codes, 17% more than at the end of 2020. In addition to this increase, new topics have recently entered our self-regulation activity, such as managed portfolios, new fund liquidity management rules, and sustainable investment funds (ESG), increasing the complexity and scope of our supervisory work.

ADuring the year, 9,200 requests for clarifications were recorded, nearly double the number recorded in 2020, and more than 1,700 guidance letters (an increase of more than 50% over 2020), which reinforces our educational role in recent topics such as managed portfolios and transparency in compensation and trading of COE/CCB (Structured Operations Certificates/Bank Credit Bill).

Parallel to this, several statements of commitment were signed, thus demonstrating institutions’ commitment to improving and revising any practices that disagree with our rules, in addition to implementation. Further, more than 1,500 fines were applied during the year; most of the irregularities refer to errors and delays in sending information to register the funds in our database. All proceeds from payment of fines are earmarked to fund educational events and other actions promoted by ANBIMA.

It is also worth highlighting the expansion of partnerships with the CVM in 2021, to take advantage of the oversight activity performed by ANBIMA with regard to investment funds, by including our supervision of the framework/mandate of the funds’ portfolios, and an agreement concerning the monitoring of influencers that talk about investments on social media.

Below are the main figures for this area:

5,108

Requests for clarification

1,286

Guidance letters

1,017

Objective fines

25

PAIs Procedures for Investigating Irregularities

1

Letters of recommendation

12

Lawsuits

21

Statements of commitment

5

Judgments

4,516

Requests for clarification

1,139

Guidance letters

1,254

Objective fines

12

PAIs Procedures for Investigating Irregularities

3

Letters of recommendation

14

Lawsuits

14

Statements of commitment

9

Judgments

9.215

Pedidos de esclarecimento

1.772

Guidance letters

1.526

Objective fines

9

PAIs Procedures for Investigating Irregularities

1

Letters of recommendation

5

Lawsuits

28

Statements of commitment

5

Judgments

Eventos

In June, we held the Self-Regulation Week, featuring five days of debates on different topics of interest to members.

The event – which took place June 21st to 25th, was streamed exclusively online through the Member Space on Workplace, from 12 noon to 1 pm daily. The live webcasts addressed issues such as ESG funds, distribution of investment products, the investment fund industry, the structuring of public offerings, and agreements with the regulatory agency.

The complete content can be found on our YouTube channel as well as the podcast platforms Spotify, Deezer, Apple Podcasts e Google Podcasts.

Below is a daily breakdown of the discussions:

June 21st – ESG Funds

138 views on Workplace

+ 440 views on YouTube

June 22nd – Challenges of remote work

112 views on Workplace

+ 160 views on YouTube

June 23rd – Distribution of investment products

107 views on Workplace

+ 270 views on YouTube

June 24th – Latest developments of the Public Offers Code

115 views on Workplace

+ 130 views on YouTube

June 25th – Advances in agreements between the CVM and ANBIMA

102 views on Workplace

+ 170 views on YouTube

Compliance and Legal

After revamping internal policies and rules and reviewing our Code of Ethics and Professional Conduct in 2020, we consolidated the Integrity Program training calendar, with a series of training activities for employees.

The Be Compliance platform – a tool adopted in 2020 that gathers documents and policies related to ethics – concentrated on seven of the eight courses in the distance-learning format: Code of ethics; Basic Concept of Compliance; GDPA – Basic Concept of Data Protection; Third-Party Risks; Combating Workplace Bullying and Sexual Harassment; Anti-Corruption and Gratuities. There was also training on the directives established in the information security policy – based on the series The Inside Man – available on the international platform Knowbe4.

We organized workshops with experts who addressed issues including anti-corruption policies, gratuities, relationships with public officials, and consumer protection. Respect in the work environment (combating sexual harassment and bullying) and Brazil’s General Data Protection Act, or “LGPD” (Law 13709/2018) were also part of the agenda.

We implemented the GDPA (“LGPD” ) Program, with the aim of looking for possible gaps and proposing improvement plans that ensure performance within the legal limits. Another effort that intensified during the year was related to AML/CFT (Anti-Money Laundering and Counter-Terrorist Financing). We advised the Legal Forum on the work of the AML/CFT Commission, which made significant progress with the Central Bank of Brazil for the identification of final beneficiaries of investment funds.

The issue was widely debated throughout the year. Two of these webcasts are available on YouTube: Changes to AML/CFT, content, in March, and Money laundering prevention: Identifying the final beneficiary in exclusive funds, in June.

People GRI 102-7, 102-8, 103-2, 103-3 | 201, 401, 405

In 2021, the Human Resources department gave way to the People, Health and Sustainability department, created so as to better reflect the new responsibilities of the area, especially regarding the consolidation of an integrated sustainability strategy. Structured to guide the ESG strategy in-house, as well as to monitor and advise all the Association’s main divisions, this department spearheads or supports various initiatives.

At the end of 2021, the area worked on defining the Association’s new sustainability strategy, including public commitments linked to the UN Sustainable Development Goals. Starting in March 2022, work began on disseminating the strategy and identifying the actions to put it into practice.

Among the initiatives associated with the strategy is the implementation of a robust diversity and inclusion program, which we present below.

Diversity

census

To increase diversity among the employees, we structured an internal program whose starting point was a census conducted to diagnose our level of maturity regarding this issue. Here are the results:

All positions

26,06%

Black (98)

73,93%

Other races (278)

Managerial positions

91,11%

White (41)

8,89%

Black (4)

PWDs per position

7

Profissional

4

Support

PWDs by gendero

54,55%

Men

45,45%

Women

The census served as the basis for defining an action plan with targets and metrics, which have racial inclusion as a priority; this includes linking variable pay to the results achieved in Diversity and Inclusion, and is an institutional goal for 100% of employees.

To develop and carry out the initiative, we have the support of the consulting firm Empodera, which specializes in D&I projects. During the first ten-month journey, there were in-house actions geared toward improving writing skills and raising awareness, some of which included 75% of the employees. With this high degree of spontaneous engagement, progress was rapid.

We also created the Diversity Volunteers group, with 77 people. In late 2021, the structuring of four affinities groups marked yet another step in the consolidation of the strategy. The groups focused on Race, Women in Leadership Roles, People with Disabilities, and LGBTQIA+, each one of which are Executive Committee members, as sponsors.

In racial D&I, the target within four years is to have 52% of our workforce composed of Black and mixed-race people. In 2021, however, even before the target was defined, our selection process already became more inclusive – 48 Black or mixed-race people were hired. This reflects the result of the in-house actions for improving writing skills and raising awareness during the first ten-month journey.

We ended 2021 with 384 employees, 7% more than in the previous year. These people are mostly located in São Paulo (58.6%), a city that gathers all business areas. The Association’s headquarters are in Rio de Janeiro, with Administrative, Legal, and Human Resources activities, as well as the Selic office, located in the Central Bank of Brazil’s building.

All employees work eight-hour shifts, apart from interns (who work six hours a day) and young apprentices (who work four hours a day). Interns and apprentices receive all the benefits offered to other employees. GRI 401-2

Employees per office

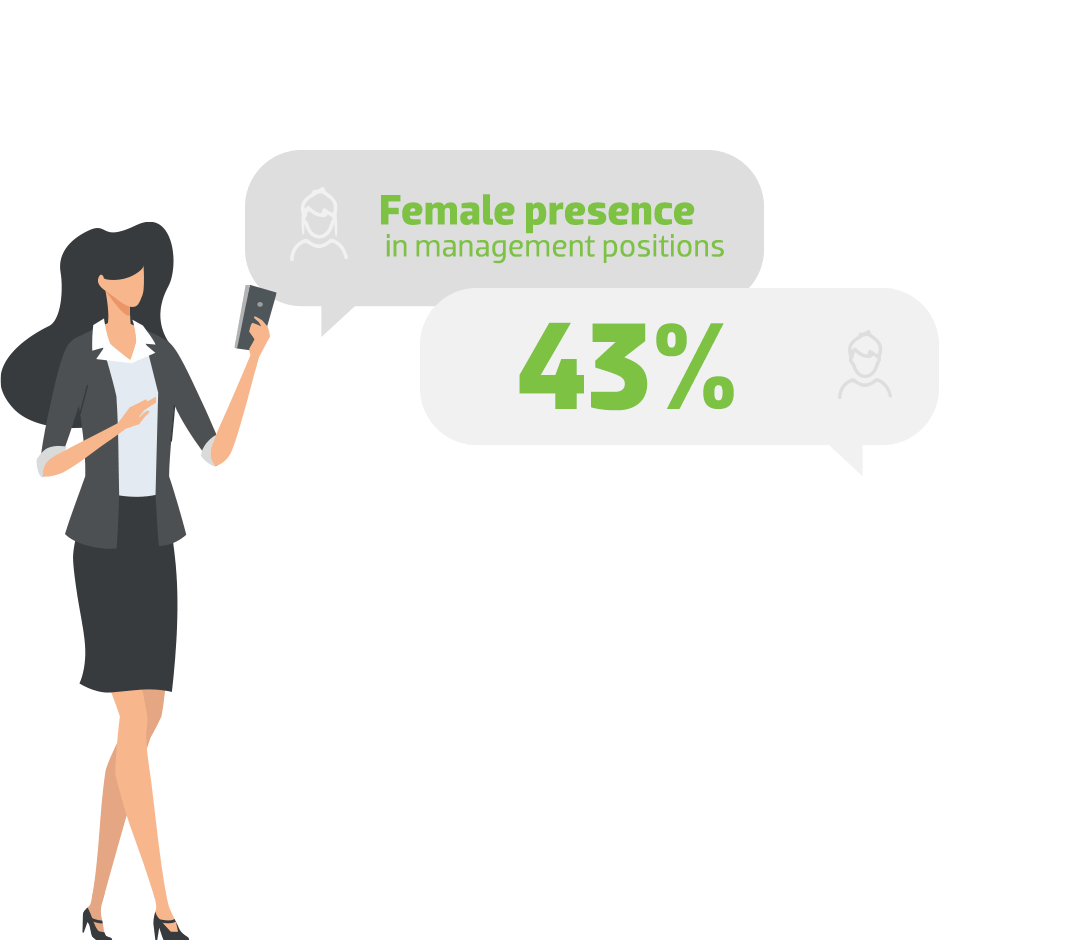

The gender proportion among employees remained practically unchanged from the previous year: 57% men and 43% women. Among leaders, women head two of the five superintendencies.

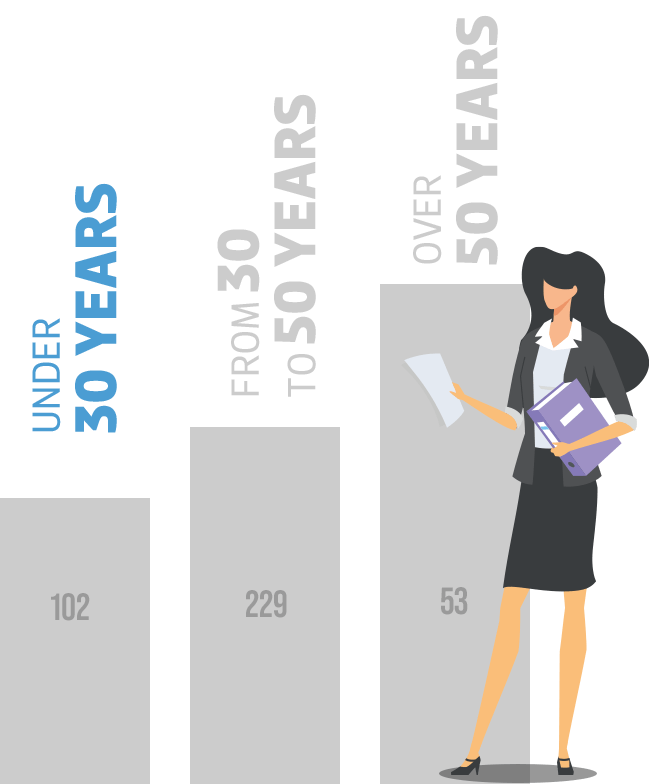

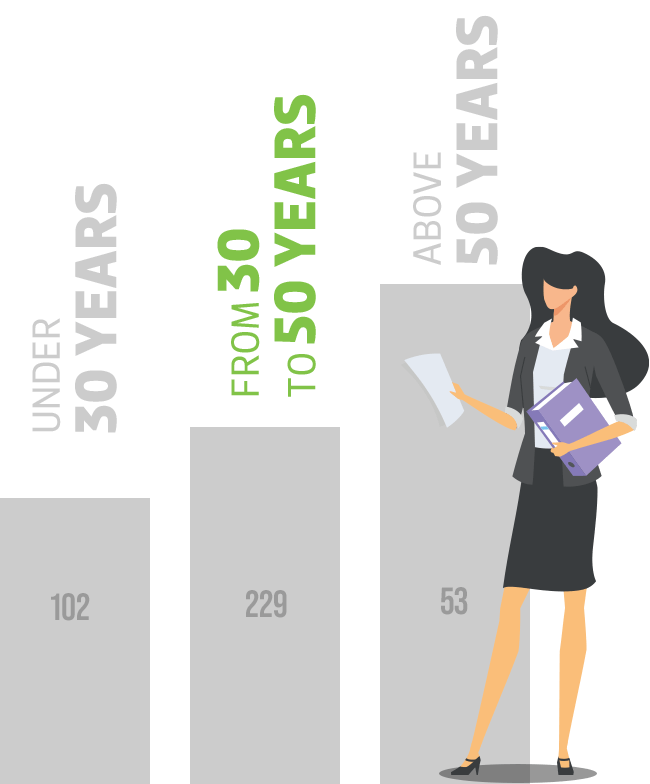

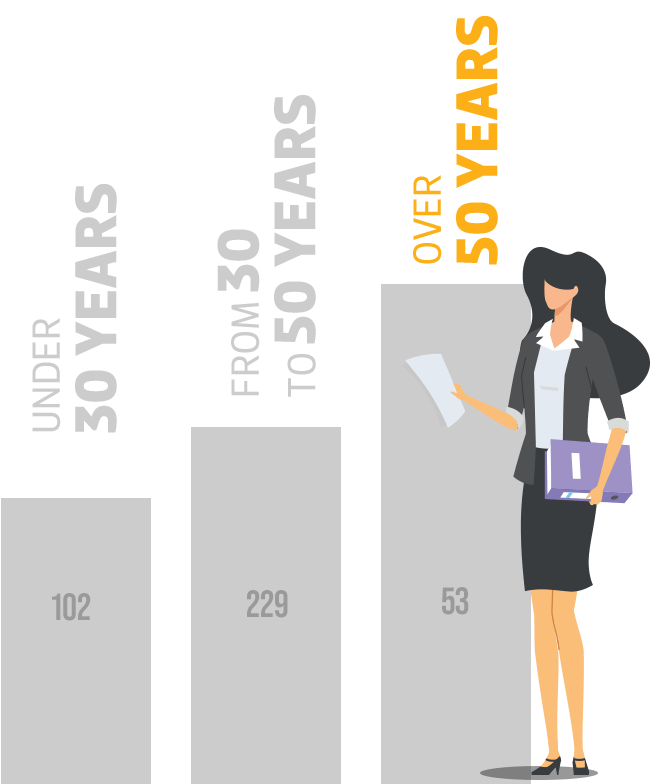

In terms of age, the team is made up of professionals of all ages; in 2021, 59.6% of them were between 30 and 50 years old. In December, the youngest was 18 and the oldest was 65. We seek to give everyone a chance based on competence and not age; proof of this is that we have a 35-year-old intern!

Positions

by gender GRI 405-1

Our age

Time at the

organization

Employer brand

We seek to consolidate ANBIMA as an employer brand through work commanded directly by our CEO with the involvement of all leaders. The focus is on training people and establishing succession plans capable of attracting and retaining talent.

In the field of training, one of the latest developments is in our internship program, which now has a project to prepare professionals to work in the financial market, and not necessarily at the Association. The program – which got underway in July – consists of five people hired for a two-year period, during which time they will switch areas/departments every seven months and receive technical training and development of soft skills. Selected by an external consulting firm, the process did not set age limits for participants or limit enrollment to students from top universities.

As for recruitment and selection, the biggest challenge of 2021 reflected a particularity of the job market: hiring technology professionals. This issue specifically impacted the Organization, given the moment we are going through: the Association is experiencing a process of evolution, focused on consolidating its vocation as a data hub for the market, incorporating increasingly analytical capacity to qualify the information we return to members and to society in general. In addition to the technology per se, the foundation for this is people – professionals for whom the demand is rising sharply.

Accordingly, we also invested in the training of a more digitalized team, with leadership training and the use of streamlined methodologies.

Hybrid and safe work GRI 103-2, 103-3 | 403, 403-3, 403-6, 403-8

While 2020 was a year of learning, 2021 was a year of stability. We received good feedback from the market on our way of dealing with remote work, with no reports of lost productivity.

As a result, the work-from-home model that started in March 2020 continued in the first half of 2021, with 100% of the team working remotely. Starting in September, a hybrid work schedule was created for the offices in São Paulo and Rio de Janeiro (Mourisco), where managers began working in person three times a week, and the other employees, twice a week. Following the Central Bank of Brazil’s guidelines, the Selic team remained at home, as did pregnant employees or those with children less than one-year-old.

Space occupancy was maintained at 40%, and N95/PFF2 masks were handed out, with mandatory use in the offices. Employees were also encouraged to participate in the vaccination campaign to ensure the immunization of as many people as possible. Additionally, employees and their dependents covered by our health plans were able to receive flu vaccines (H1N1) free of charge.

Economic–financial results GRI 103-2, 103-3 | 201

System integration and migration from analog to digital processes allowed for gains in operational efficiency in the corporate controllership area. The focus was on reducing costs through process automation and financial management.

In 2021, we recorded the lowest default rate in history: in July, the index reached 1.41%. In Consolidated for the year, several initiatives favored the Association’s cash account, such as:

- Implementation of a specific portfolio to manage cash, which obtained profitability above the Selic and IMA-B rates;

- Renegotiation of lease contracts, reduction of corporate condominium maintenance fees, and renegotiation of service agreements;

- Possibility of payment in installments for certification exams, which now accept payment via the Pix instant payment platform.

Lowest default rate in history: in July, the index reached 1.41%.

Below, we present our financial statements for the year. Available for download at this link, PwC audited the results. After a three-year engagement with KPMG, we switched to independent auditing, following the best governance and controllership practices.

Positive Agenda

Positive Agenda