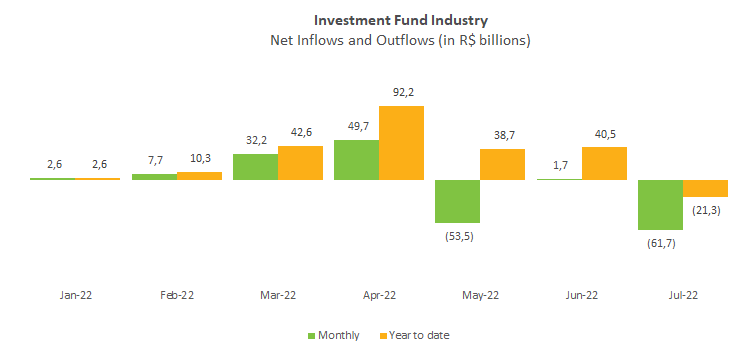

Investment fund industry sees R$61.7bn outflow in July

The investment fund industry posted net outflows of R$61.7 billion in July, reversing the balance of 2022: to redemptions of R$21.3 billion in the first seven months from R$40.5 billion of inflows until June. The result was impacted mainly by four industry classes: FIDC (Credit Receivables Investment Funds), Fixed Income, Balance-Mixed and Equity.

FIDCs had net outflows of R$23.8 billion in July while R$25.2 billion was redeemed by a single fund in the class, indicating the move does not translate into a market trend. In 2022, FIDCs show net inflows of R$8.6 billion.

Fixed-income funds faced outflows of R$17.6 billion in July, also a result of R$17.8 billion redeemed by a single fund. With high interest rates remaining on the horizon, fixed-income funds are still attractive to investors by matching higher returns with a more conservative strategy, which explains their higher balance among all fund industry’s classes in 2022 at R$83.6 billion.

The Balanced-Mixed and Equity classes, with more volatile portfolios, had outflows totaling R$21.6 billion in July. Investors pulled R$13.3 billion out of Balanced-Mixed funds, while Equity funds saw outflows of R$8.3 billion. The same dynamic is seen in the year through July: Balanced-Mixed funds saw outflows of R$73.3 billion, while redemptions from Equity funds totaled R$52.4 billion. Uncertainties about the global outlook coupled with doubts about Brazil’s economy in a year with presidential elections help fuel risk aversion among investors.

In terms of returns among funds with the largest assets, the Short Duration - Investment grade gained 1.04%. In the Balanced-Mixed funds, the Foreign Investment rose 1.05%. Among Equity funds, the Equity - Free Portfolio type rose 5.58%.