Quick access:

Quick access:Introduction

Investment is an increasingly present subject in Brazilians day-to-day lives, be it in social media, blogs, newspapers, TV, or even in chats with friends and family. To help us understand Brazilians behavior when the theme is finance, our traditional survey “The X-Ray of the Brazilian Investor” reaches its third edition, bringing about data related to 2019.

Data collection was done, with Datafolha's support, in November 2019, encompassing 3.433 people scattered in 149 municipalities, who represent more than 96 million Brazilians. All of them with ages of 16 and above, belonging to classes A, B or C, and economically actives (earning income or pensions). Therefore, the survey does not reflect Covid-19 impacts on the population. As we are already aware of, the crisis will turn Brazilians and the world poorer, a situation which makes savings and investment even more relevant themes and bestows legitimacy to the survey’s findings.

Some glimpses of the survey’s main findings are shown below. If you wish to learn more, you can download the full report and the complete data here

Who are they?

Less than half of Brazilians (44%) had some money allocated in financial products in 2019. That is, 42 million Brazilians had some kind of financial investment last year. The percentage points to a growth in comparison to the two survey previous years, in which findings pointed to 42% of Brazilians putting money into investment products.

But, then, what is the Brazilian investor profile? There goes the answer: the majority of them are male (53%), married, belong to class C, and have an average monthly income of R$5,6 (Five thousand and six hundred Brazilian reais). Have a look below at the complete X-Ray image:

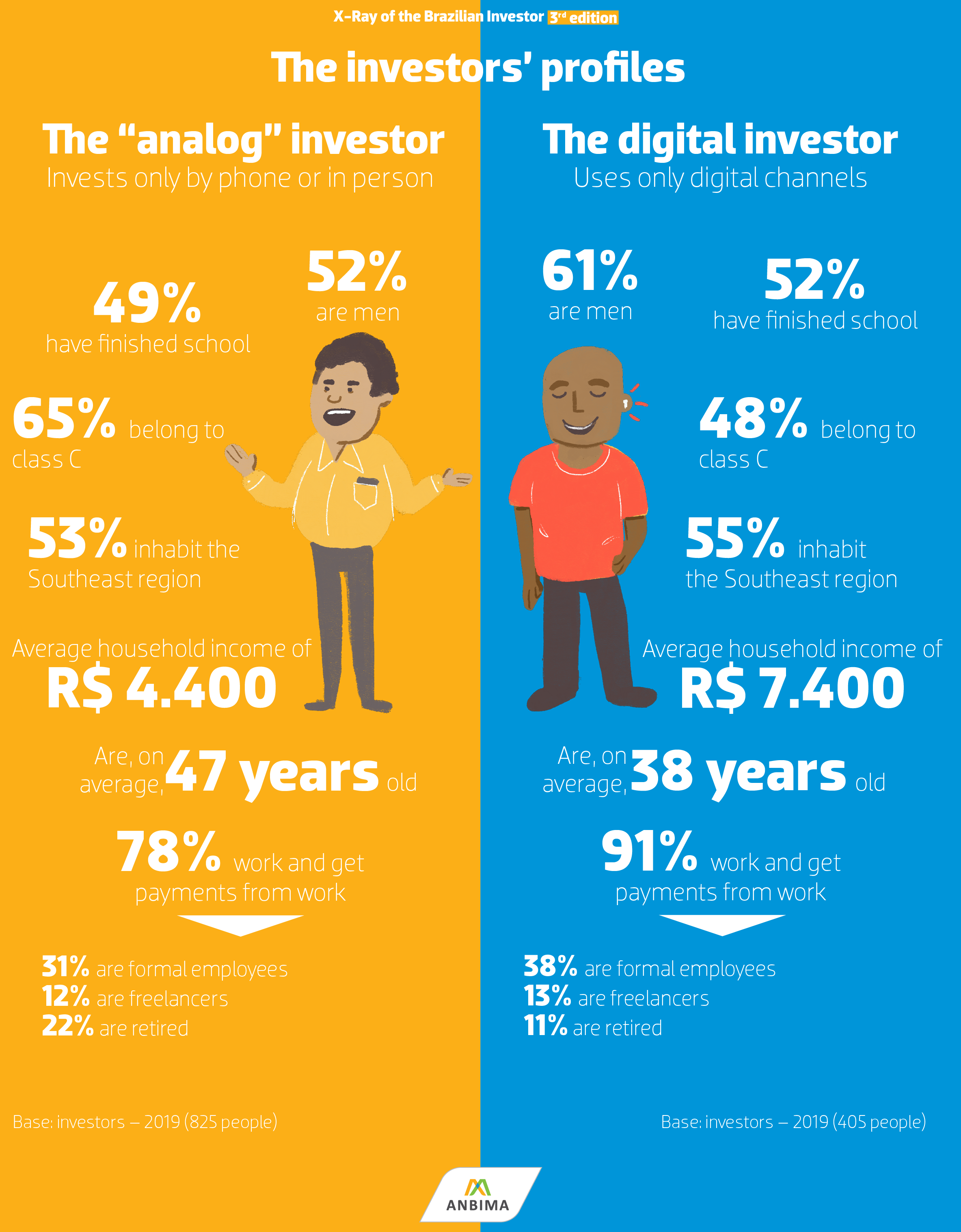

The digital investor versus the “analog” investor

The Brazilian investor is attached to tradition. The vast majority, 71%, go to a bank branch to make their investments. On the other hand, 49% prefer to use the bank’s or broker's website or apps. The more conservative ones, which we call “analog investors”, tend to be older - on average 47 years old -, from class C, with a monthly family income of around R$4,400. Retirees represent 22% of this group. Meanwhile, those who use the internet to make financial life easier are those we call the “digital investors”. They are younger - on average 38 years old - and have stronger purchasing power: they belong to class B and have an average monthly income of R$ 7,400.

What they invest in

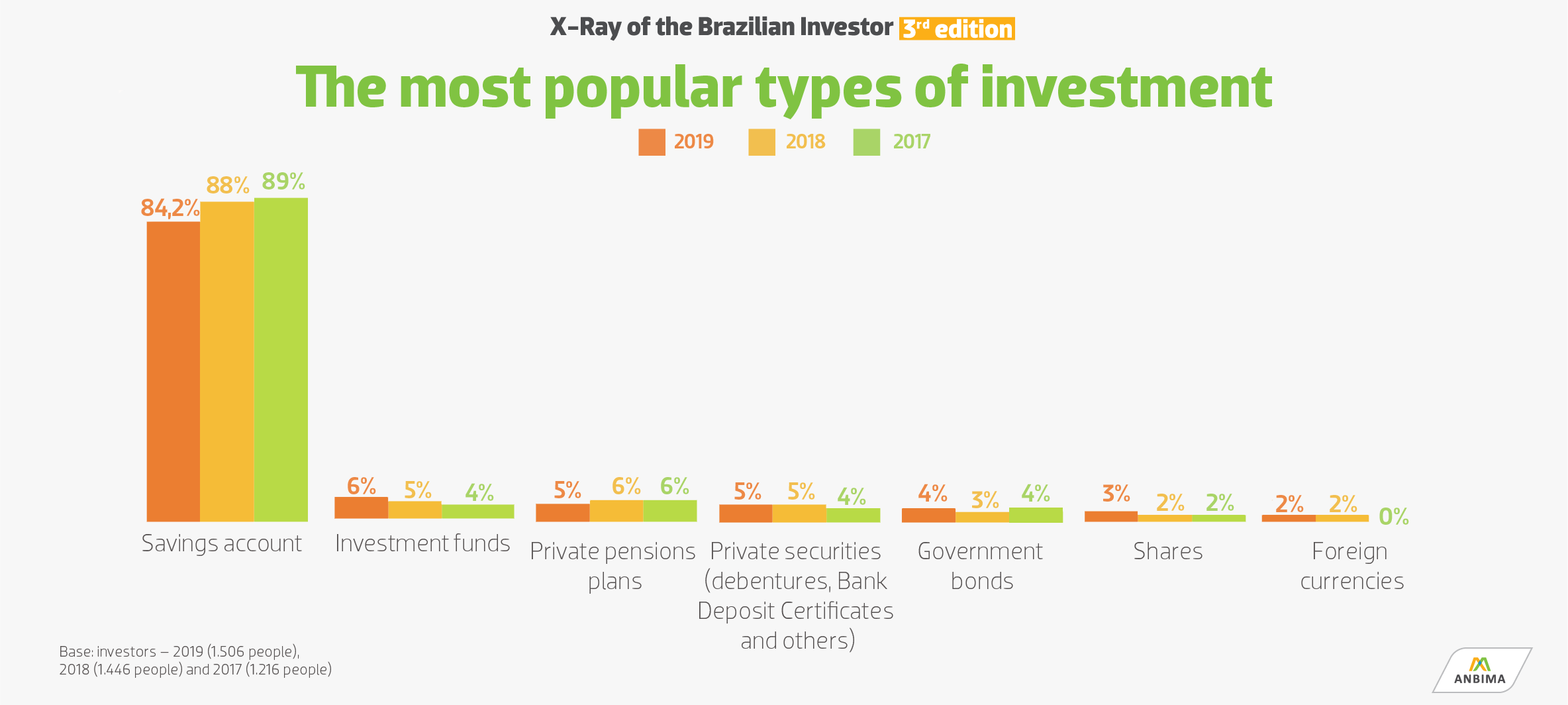

Savings accounts keep the lead as the favorite product of investors but have been losing share: 84% kept their resources invested in saving accounts in 2019, while 88% chose them in 2018, which corresponds to a four-point fall.

Subsequently, there come the investment funds (6%), followed by private securities (5%), private pension plans (5%), government bonds (4%) and shares (3%). Shares, despite being one of the best-known investment products by Brazilians – second only to saving accounts -, hold still little appeal for investors.

Savings-accounts fans versus the rest of the investors

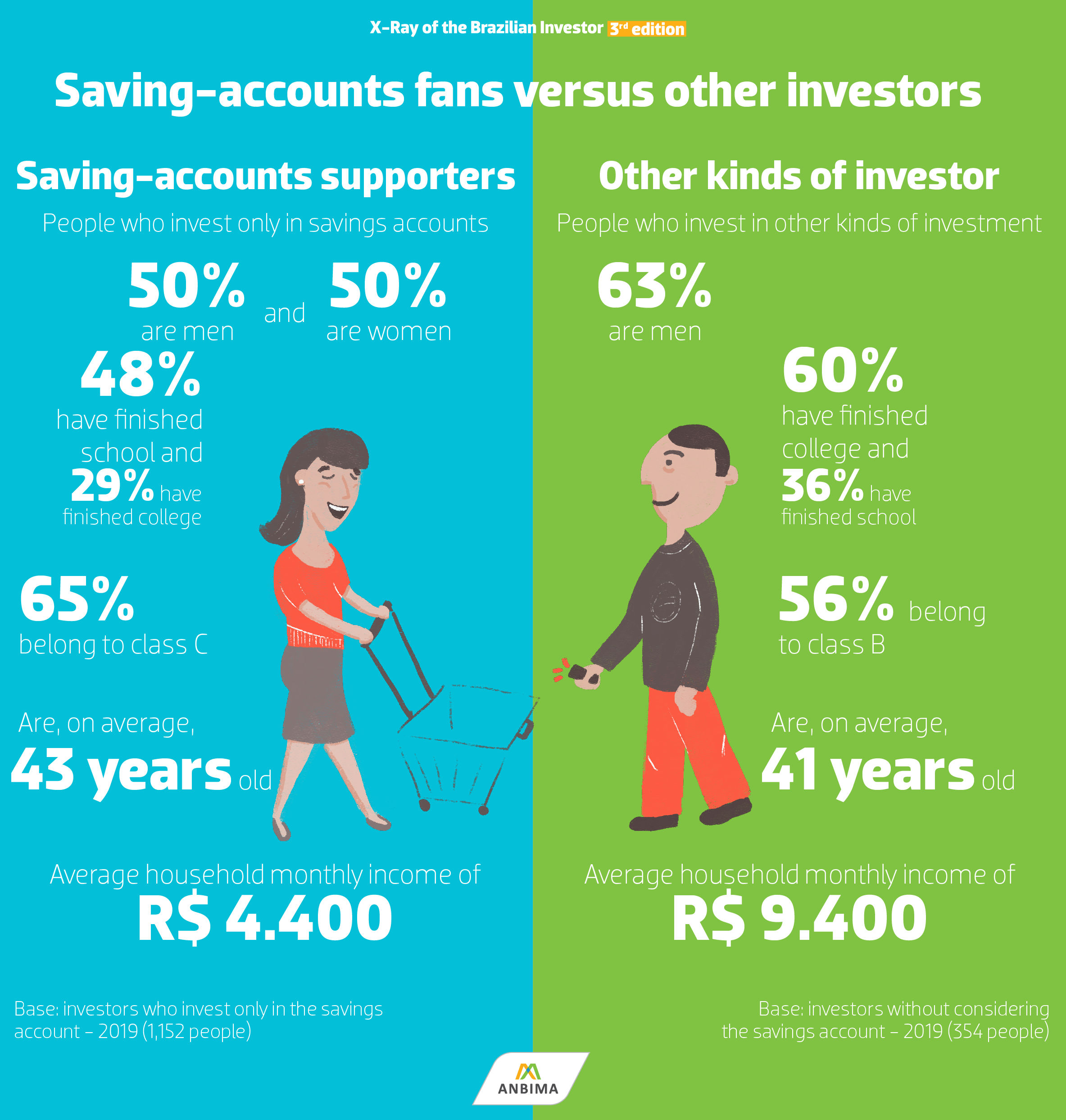

Within the investors’ universe, there two distinct profiles: those who invest exclusively in saving accounts, and the rest of them, who might or not have money invested in saving accounts but invest in other products. The saving-accounts supporters are evenly divided between men and women (50% in each gender), belong to class C (65%), have completed school (48%), and have an average monthly income of R$ 4,400 (Four thousand and four hundred Brazilian reais). The majority of them are men (63%), from classes A or B (72%), have finished college, and an average monthly income of around R$ 9,400 (Nine thousand and four hundred Brazilian reais).

Savings-accounts fans versus the rest of the investors

Within the investors’ universe, there two distinct profiles: those who invest exclusively in saving accounts, and the rest of them, who might or not have money invested in saving accounts but invest in other products. The saving-accounts supporters are evenly divided between men and women (50% in each gender), belong to class C (65%), have completed school (48%), and have an average monthly income of R$ 4,400 (Four thousand and four hundred Brazilian reais). The majority of them are men (63%), from classes A or B (72%), have finished college, and an average monthly income of around R$ 9,400 (Nine thousand and four hundred Brazilian reais).

Retirement

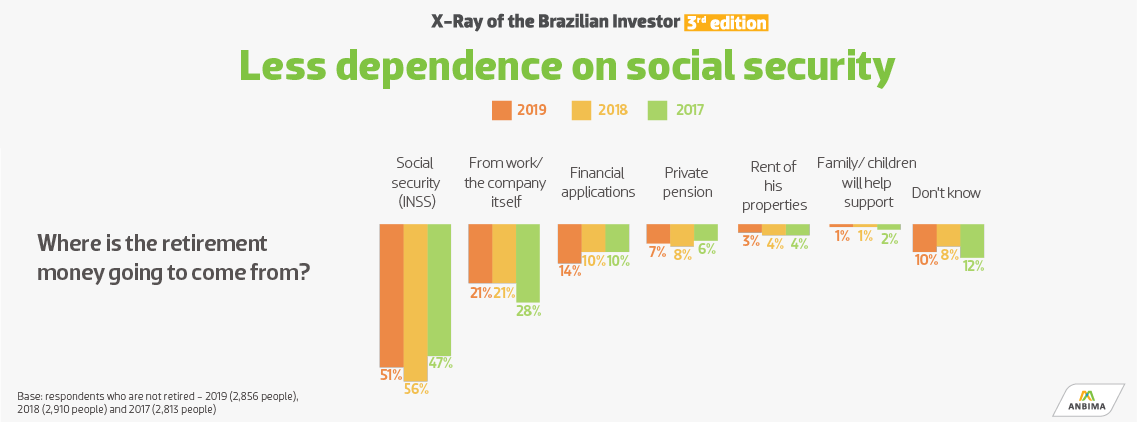

Even with the social security reform in all the news, the Brazilians perception of retirement little changed in 2019. Most think about retiring, on average, at 59 years of age. However, the number of Brazilians seeking to depend only on social security in old age fell, from 56% in 2018 to 51% in 2019. The number of people who will use financial investments as allies in old age has increased: 14% will make use of these resources, up to four percentage points compared to 2018.

PREVIOUS SURVEYS