QUICK ACCESS

QUICK ACCESSIntroduction

This is the revised edition of the ANBIMA-B3 Agenda for Capital Market Development. The first version was launched in 2018 , based on efforts by ANBIMA and B3 to consolidate a set of proposals capable of stimulating growth of the fixed-income and equity markets.

Two years later, we gathered again to update the document, which lists initiatives of a microeconomic nature, and to propose suggestions for regulatory adjustments that can contribute toward the expansion of private long-term financing instruments. Click here to read the entire report.

Context

The recent performance of the capital market has revealed this segment’s potential to meet the financing needs of our economy and the allocation of savings held by Brazilian investors. The sector had been on an upswing in recent years, but underwent a sharp decline due to the shutdowns resulting from the COVID-19 pandemic and has subsequently started to bounce back.

Even in a crisis scenario, the capital market was able to meet the needs of companies and investors. Conditions for this upturn were provided by a set of factors that gained strength mainly starting in 2017, with decreasing participation by BNDES in long-term financing. Combined with the cycle of lower interest rates and the onset of structural reforms, these changes helped to create a more favorable environment for issue of securities.

The increase in issues took place within a context of lackluster growth in the Brazilian economy – an average of 1% a year between 2017 and 2019. This suggests that the market has the potential for further expansion in a scenario of accelerated economic activity.

Challenges

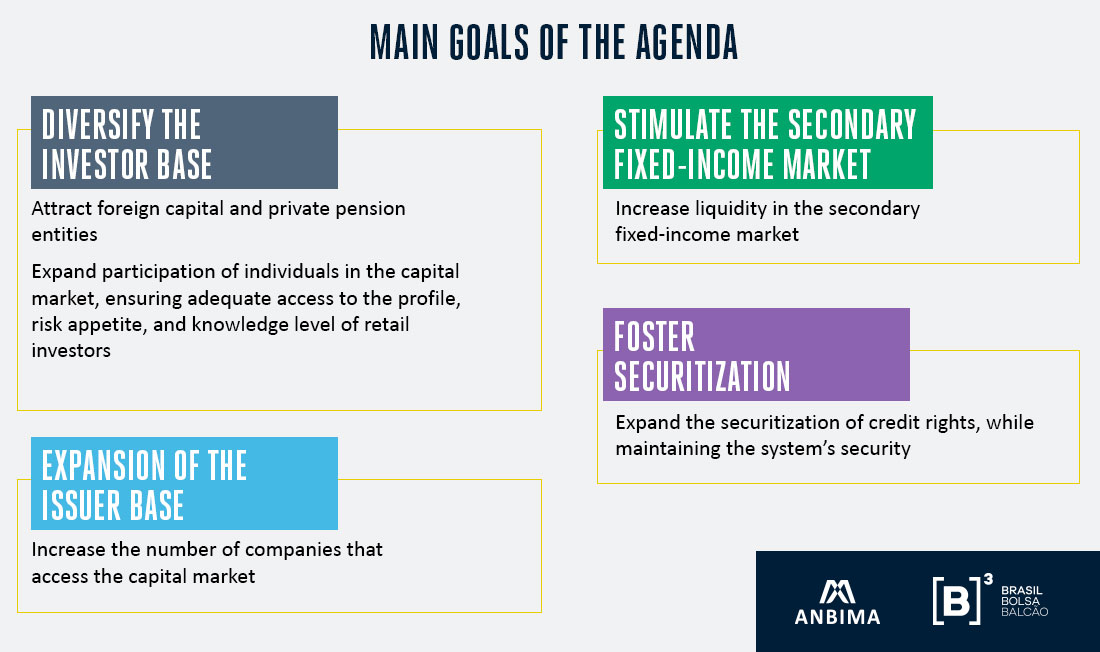

The capital market’s consolidation as a source of funds for private financing necessarily involves four major challenges. There is the need to diversify the investor base, creating mechanisms to attract foreign capital, institutional investors, and individuals. The base of companies that use the Brazilian capital market to finance themselves must be expanded on an urgent basis. Without this, there is no way to guarantee assets with different profiles to meet investors’ needs. It is also necessary to boost the secondary market for fixed-income securities, otherwise there is no liquidity – a condition that gives investors confidence in the acquisition of a particular asset. And it is necessary to foster new sectors for the securitization market, which today is strongly concentrated in the real estate and agribusiness segments.

Agenda

The ANBIMA-B3 Agenda consolidates measures to stimulate the capital market, divided into the four main pillars that ANBIMA and B3 consider as strategic: investors, issuers, secondary market, and securitization.

The agenda’s structure highlights the points where progress has been made, the initiatives that are currently in progress or have yet to be implemented, and potential opportunities for development.