Change in interest rate trajectory poses challenges for fund management in 2013

Robert J. van Dijk – vice president of ANBIMA

May/2014

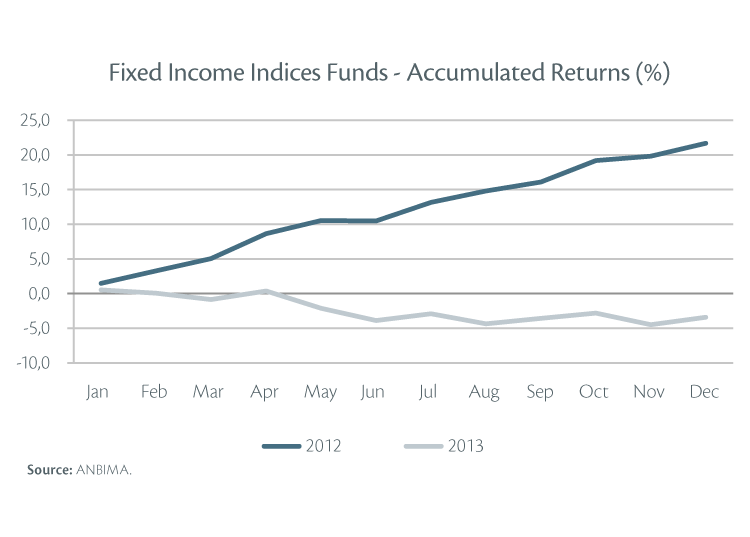

After almost two years of adapting to lower interest rates, the reversal of the interest trajectory in 2013 posed an enormous challenge for the fund industry, requiring great skill on the part of the managers in regard to the allocation of resources, which were now being directed to higher-risk assets in the pursuit of better returns. The announcement of the suspension of the U.S. monetary stimuli in May and the resulting impact on the exchange rate also increased the uncertainties surrounding the economic scenario, raising demand for more liquid assets, in turn leading to a change in the portfolios' mix. The impact of the shift in the economic scenario, which led to first annual decline in the IMA-General index (-1.42%), also affected the flow of funds into the industry and within it. The most glaring example was provided by the Fixed Income Indices funds, which had been the industry's best performer in 2012, but which now began to record net redemptions, particularly in periods of greater volatility and negative returns, underlining the need for the greater dissemination and application of suitability and investor education practices.

Active portfolio management a distinct advantage in adverse scenario

Given this scenario, despite the fact that the industry's best returns in 2013 were generated by the Foreign Exchange funds, which appreciated by 16.51%, reflecting the period devaluation of the Real, the main factor influencing fund management last year was undoubtedly the change in the interest trajectory. Following the 525 bps reduction between August 2011 and October 2012, the target for the benchmark Selic rate reached an all-time low of 7.25% p.a. It was against this background that the Fixed Income Indices funds, whose portfolios are mostly made up of NTN-Bs (National Treasury Notes) led the 2012 return rankings, appreciating by 21.69%. Nevertheless, despite the inflationary pressure that was already apparent at the end of 2012, many players thought that the Selic would remain at 7.25% p.a. throughout 2013, exemplified in January of that year by the median projections of ANBIMA's Macroeconomic Monitoring Committee and the Central Bank's Focus Report. Consequently, the 275 bps increase in the Selic between April and December 2013 seriously jeopardized the performance of fixed income assets and, consequently, returns from portfolios made up of these assets.

Given the decline in most pre-fixed and, especially, indexed fixed income assets, reflected in the 10.02% slide in the IMA-B in 2013, the Fixed Income Indices funds fell by 3.42% in the period. Unaccustomed to fixed income asset volatility and losses, many investors, especially on the retail side, redeemed their resources, in certain cases recording losses that could have been avoided if they had maintained their investment for a longer period, compatible with the average duration of these portfolios. It is worth noting that, in a greater time horizon, 24 or 36 months, for example, the Fixed Income Indices funds generate impressive returns of 17.5% and 34.4%, respectively.

Similar behavior could be observed in the Open Pension funds. The decline in profitability, together with the entry into effect at the beginning of the year of the rule extending the average maturity of pension fund portfolios as of June (National Monetary Council Resolution 4176) in a period already marked by greater uncertainty and the pursuit of lower duration assets, led to monthly redemptions in the Pension category in July and August, something that had not happened since January 2009.

The upturn in interest rates, together with lower-than-expected economic activity, also affected equities, with the result that most Equity funds recorded a decline in the wake of the Ibovespa's 15.5% annual downturn. The exception was the Free Portfolio type, which generated returns of 1.95% thanks to the greater flexibility of their portfolio composition. The best performers in the Balanced/Mixed category were the Long and Short - Neutral and Directional funds, which undertake operations that are neutral or directional in relation to stock market risk and recorded respective increases of 10.02% and 10.20%. They were followed by the Macro funds, which undertake operations with various types of asset based on medium and long-term macroeconomic scenarios and recorded an upturn of 8.49%.

As we can see, one common characteristic of the funds that did best in 2013, both in the Equity and Balanced/Mixed categories, is active management, highlighting the benefits of specialized management, especially in scenarios of greater complexity and uncertainty, where the managers' expertise in their respective markets constitutes a distinct advantage.

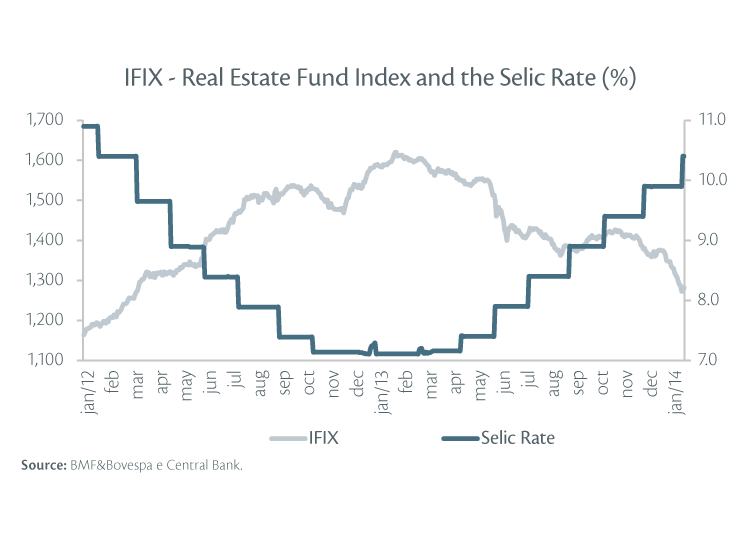

The profitability of the FIIs – Real Estate Investment Funds, which were among the best performers in 2012, fell back in 2013, jeopardized by the period interest rate trajectory and the modest performance of the construction industry, which moved up by only 1.9%, lagging GDP growth of 2.3%. The IFIX, a BM&FBovespa index that measures the performance of listed real estate funds, fell by 12.6%, versus an upturn of 35.6% in the previous year. The ratio between these funds' market cap and AuM declined from 105% in 2012 to 88% in 2013. It is worth noting that the AuM of most funds whose shares are traded on the stock market have been well above their market cap, suggesting that investors require a biter understanding of the specifics of such funds. Due to the maturation phase of the projects, especially those involving construction, the perception of medium and long-term returns is often abandoned for volatilities observed in the short term.

Still on the subject of structured products, the FIDCs (Credit Receivables Investment Funds) presented a lower pace of fund offerings than the FIIs and the FIPs (Private Equity Funds). In addition to the economic scenario, this was most likely due to the requirements of the new regulation (CVM Instruction 531, issued in February 2013), which instituted improved controls on the part of the administrator and the leading service providers, with a clearer definition of respective responsibilities, as well as prohibiting service providers and their related parties from assigning or originating credit receivables, directly or indirectly, to or from the funds.

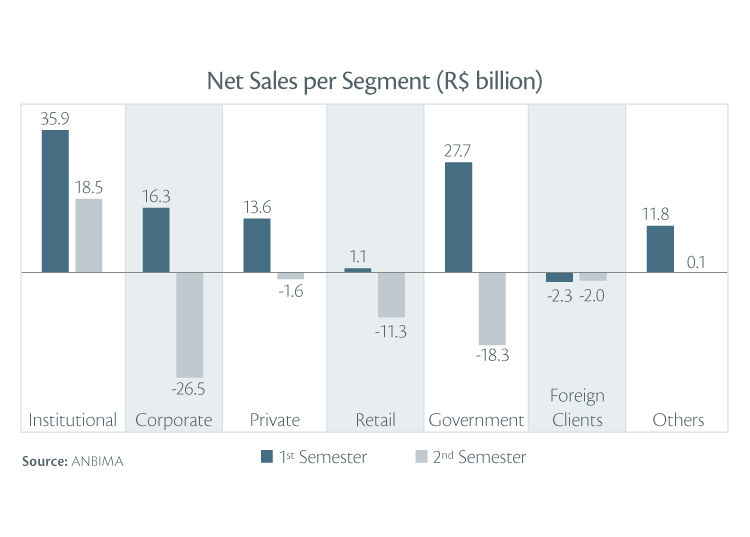

Two distinct halves

The effects of the economic scenario was also reflected in the flow of resources in the industry, which had two distinct halves. In the first, bolstered by the seasonally higher net sales of government clients and inflow of around R$20 billion from an institutional investor, net sales reached R$104 billion, a record for the period, while the second half was marked by net redemptions of R$41 billion. Even though a good part of these redemptions (R$26.5 billion) had been effected by corporate clients, whose motives are generally associated with specific cash flow needs, the reduction in returns appears to have encouraged redemptions by retail and private clients in the second half of the year, with effects on the industry's main categories. The exception was the DI-Linked funds, which posted net sales of R$13.9 billion, fueled by the upturn in interest rates. As a result, annual net sales came to R$62.8 billion, below the R$100 billion level of the previous three years.

Increased demand for liquidity affects portfolio composition

The deterioration of the fixed income and equity markets throughout 2013 led to important changes in the composition of the fund portfolios, with investors demanding greater liquidity, resulting in an increase in the ratio of shorter-duration assets. In the fixed income segment, the volume of repo operations increased from 21.1% to 24.2% of the industry's total AuM, while the ratio of government securities fell from 40.4% to 36.8%, especially LFTs (National Treasury Bills) and NTN-Fs, whose balances fell by 7% and 16%, respectively, in 2013. In the specific case of the LFTs, the reduced offering of these securities appears to have contributed to the routing of funds to repo operations (in 2013, net LFT redemptions totaled R$61 billion). As for private securities, the balance of credit receivables and long term bank debt increased by 24% and 16%, respectively. Given the stock market downturn in 2013, the equity portion remained flat at 14% of total AuM, a level it has maintained since 2011.

Investor reaction indicates the need for greater dissemination and understanding of suitability

The reaction of investors to the change in the economic scenario, especially the new interest trajectory and its impact on investment fund profitability, is certainly one of the main lessons and challenges that 2013 had in store for Brazil's fund industry. This behavior highlighted the need for improvements in the way in which the products are bought and sold and in investor education. It was not by chance that 2013 saw the publication of ANBIMA's Retail Code, which regulates the distribution of investment products in the retail market and establishes the minimum requirements to be observed by institutions operating in this segment. Also, at the end of 2013, CVM Instruction 539 was issued, which established the need to ensure that securities products and services are suitable for the client in question's profile. The rule envisages that, as of 2015, investment product brokers will have to assess and classify their clients and products into specific categories in order to determine compatibility between the objectives, financial situation and knowledge of the former and the characteristics of the latter, in line with the requirements present in ANBIMA's codes since 2007. It is worth emphasizing that this Instruction was the result of a lengthy process of public discussion, begun in 2006, and the object of three public hearing notices (in 2007, 2009 and 2011). Needless to say, ANBIMA, as the association representing the financial and capital market and due to its experience of the issue, played a major role in this process.

We therefore believe that these instruments, together with the ongoing alterations to CVM Instruction 409, which regulates the investment funds, represent important steps forward in the development of our industry, ensuring that investments are increasingly aligned with investors' needs, thereby avoiding tendencies such as those we witnessed last year.